Unlocking Financial Opportunities with Business Credit Builder

For entrepreneurs looking to establish and grow a successful business, having access to capital is crucial. Often, traditional lenders require personal guarantees or collateral, making it difficult for new businesses to qualify for loans or credit cards. This is where a business credit builder becomes invaluable.

The Benefits of a business credit builder program

Business credit builder programs are designed to help small businesses build credit in their company’s name separate from their personal credit. By establishing a positive credit history, businesses can access funding, secure better terms with vendors, and improve their overall financial health.

Some key benefits of a business credit builder program include:

- Separation of personal and business credit profiles

- Access to higher credit limits

- Improved credibility with lenders and suppliers

- Potential for better interest rates on loans

- Protection of personal assets in case of business debts

Understanding business credit builder accounts

Business credit builder accounts are specialized credit products designed to help businesses establish credit history. These accounts may include business credit builder cards, loans, or tradelines that report to business credit bureaus.

By using these accounts responsibly and making timely payments, businesses can build a positive credit profile over time. This can open up opportunities for larger lines of credit and favorable financing options.

Frequently Asked Questions about BUSINESS CREDIT BUILDER

1. How long does it take to build business credit with a credit builder program?

Building business credit takes time and consistency. Typically, it can take several months to see significant improvements in your business credit score.

2. Can a business credit builder program help me obtain financing for my business?

Yes, a strong business credit profile can make it easier to qualify for loans, credit cards, and other financing options for your business.

3. Are there any risks involved in using a business credit builder program?

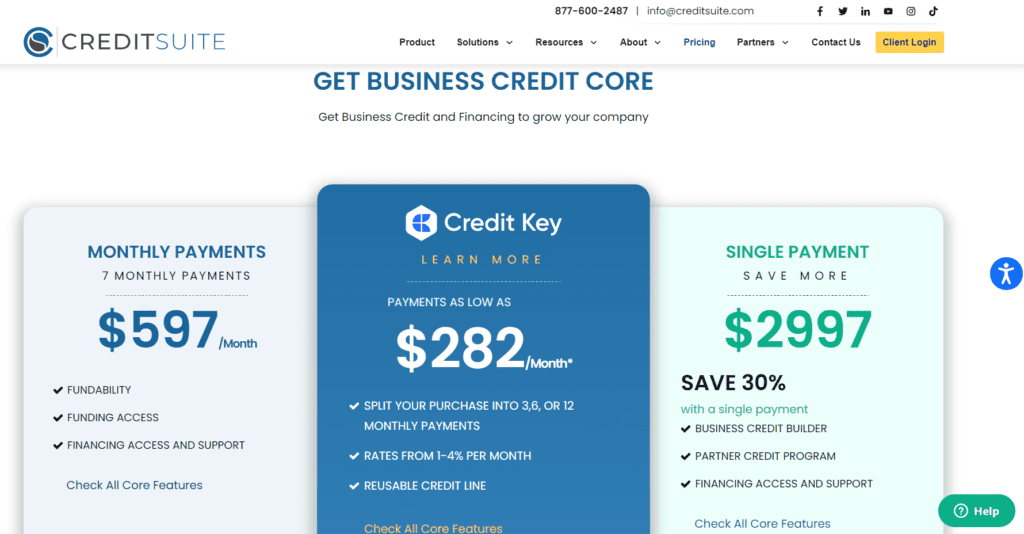

While business credit builder programs can be beneficial, there may be risks involved, such as high-interest rates or fees. It’s important to carefully review the terms and conditions of any credit-building products.

4. How can I find reputable business credit builder companies?

Researching online reviews and asking for recommendations from other business owners can help you find reputable business credit builder companies that have a proven track record of success.

5. What are the key features to look for in business credit building services?

When choosing a BUSINESS CREDIT BUILDER service, look for features such as credit monitoring, access to multiple credit products, and personalized guidance on improving your credit profile.

Conclusion

Building a strong business credit profile is essential for the long-term success of any business. With a business credit builder program, businesses can take control of their financial future, access the capital they need to grow, and establish credibility in the eyes of lenders and suppliers.

By leveraging the benefits of business credit builder programs and working to maintain a positive credit history, entrepreneurs can set their businesses up for success in the competitive marketplace.